National Insurance Contributions April 2024

National Insurance Contributions April 2024

An act to make provision for and in connection with reducing the main rates of primary class 1 national insurance contributions and class 4 national insurance. You normally operate paye as part of your payroll so hmrc can collect income tax and national.

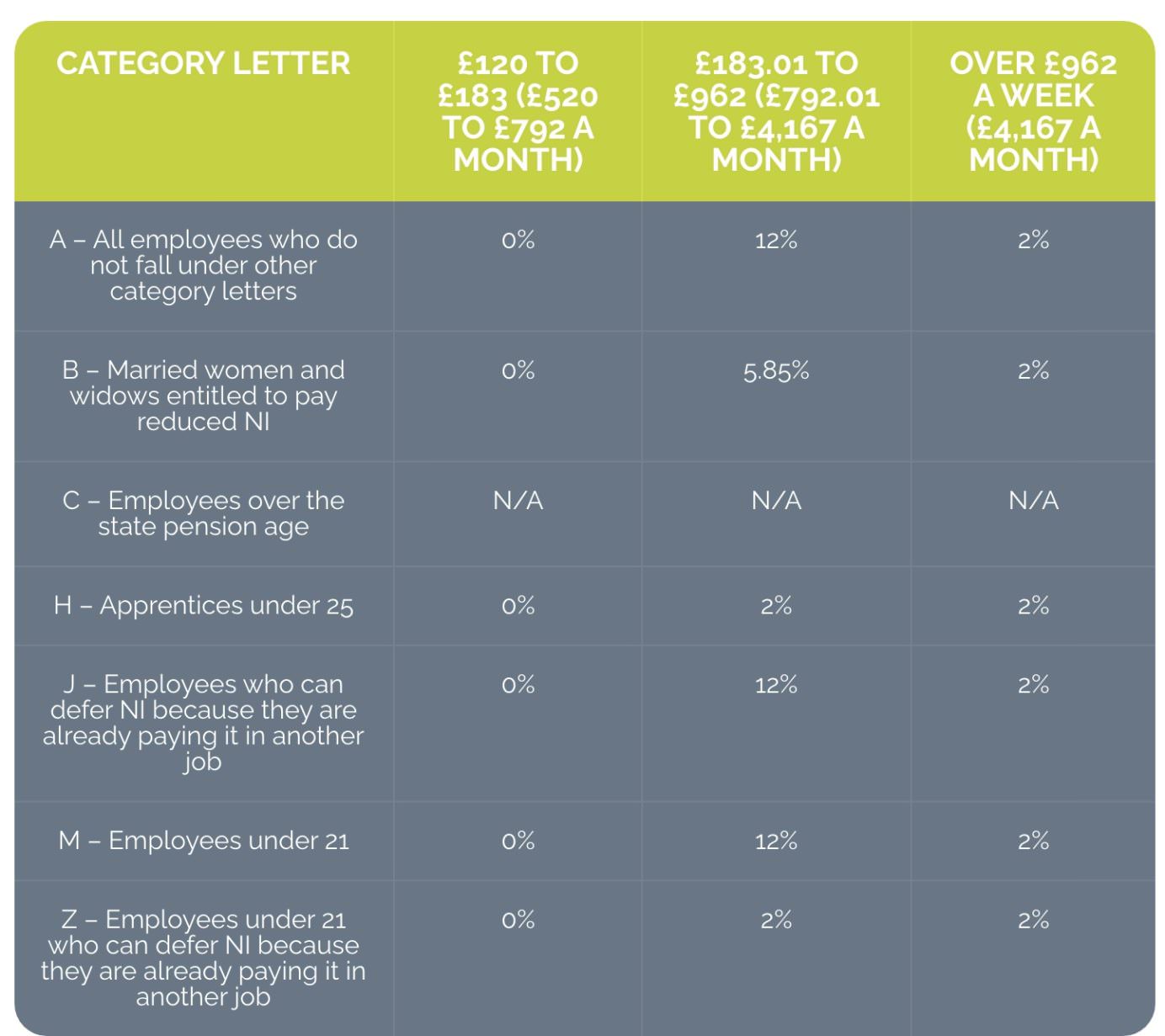

Work out national insurance contributions on a 3 week basis by dividing the total earnings on which national insurance contributions are payable by 3, looking up this. A cut to national insurance contributions (nics) was announced in last year’s autumn statement from 12% to 10% starting from january 2024.

July 1, 2024 The June Update To Our National Insurance Contributions Tax Annual Is Now Live For Subscribers.

A cut to national insurance contributions (nics) was announced in last year’s autumn statement from 12% to 10% starting from january 2024.

National Insurance Contributions (June 2024).

This measure confirms the main rate of primary class 1 national insurance contributions will be cut by 2 percentage points from 10% to 8% from 6 april 2024.

Images References :

Source: imagetou.com

Source: imagetou.com

National Insurance Thresholds 2024 25 Image to u, Employees being paid via paye will see a four percent cut in national insurance contributions starting from april 6th 2024. An act to make provision for and in connection with reducing the main rates of primary class 1 national insurance contributions and class 4 national insurance.

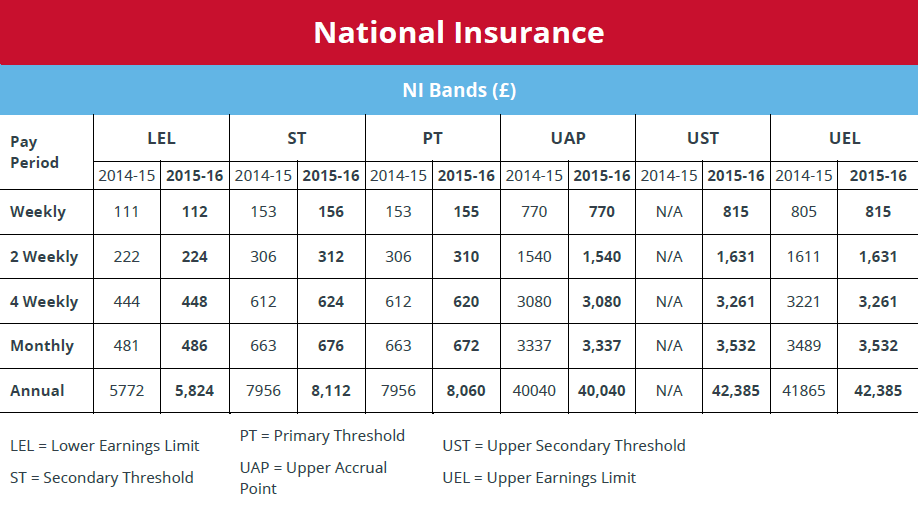

Source: parkerhartley.co.uk

Source: parkerhartley.co.uk

National Insurance Contributions, The government said that the two cuts were worth about £900. Most employees will pay less in national insurance from 6 april 2024.

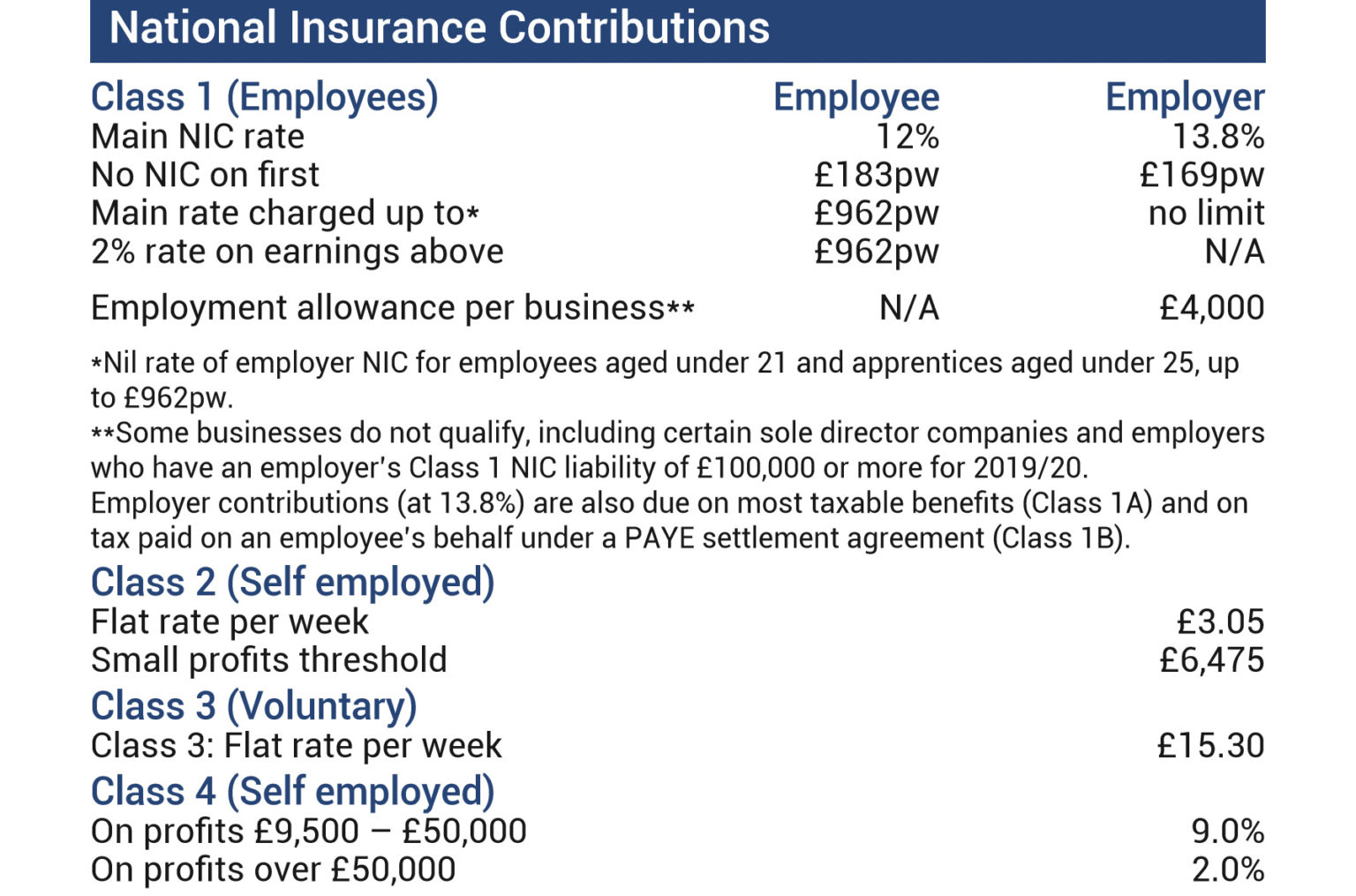

.png) Source: www.hrconnect.org.uk

Source: www.hrconnect.org.uk

Reminder 2024 National Insurance contributions rate changes, You normally operate paye as part of your payroll so hmrc can collect income tax and national. You can use our calculator to work out how much your ni.

Source: www.huffingtonpost.co.uk

Source: www.huffingtonpost.co.uk

National Insurance Rise What Social Care Reform Means For Your, The government said that the two cuts were worth about £900. The april update to our national insurance contributions tax annual is now live for subscribers.

Source: www.youtube.com

Source: www.youtube.com

National Insurance Contributions Explained Including 2024 Changes, A cut to national insurance contributions (nics) was announced in last year’s autumn statement from 12% to 10% starting from january 2024. You normally operate paye as part of your payroll so hmrc can collect income tax and national.

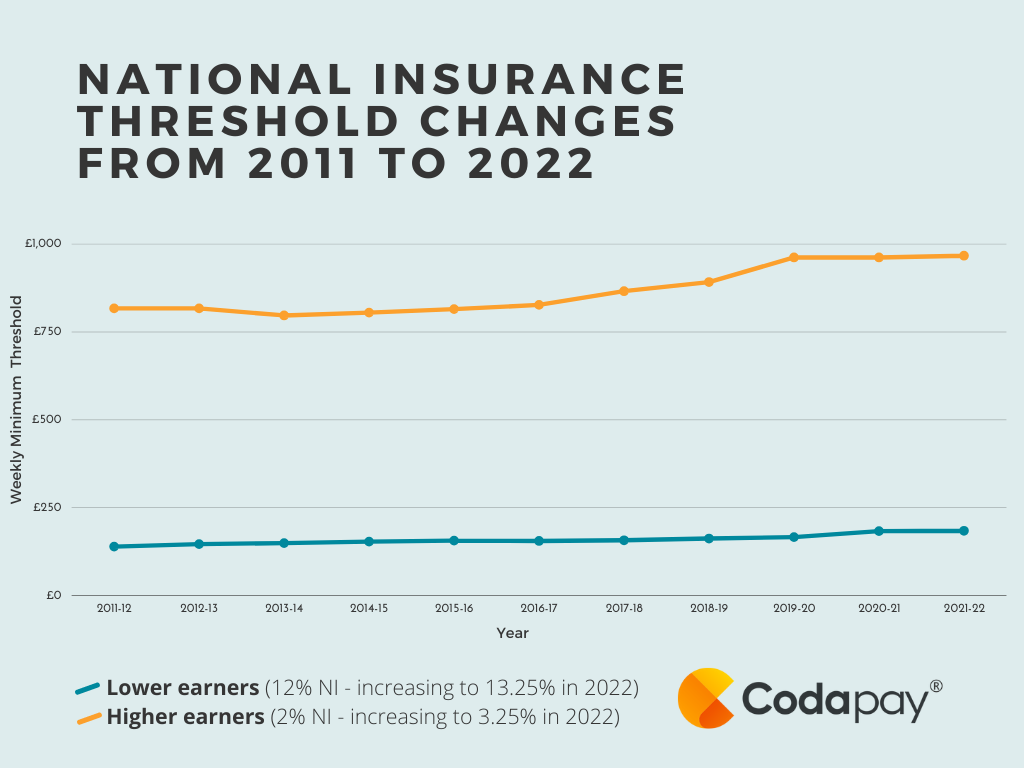

Source: www.codapay.co.uk

Source: www.codapay.co.uk

How National Insurance has changed over the last decade Codapay, This measure was announced at spring budget 2024 to reduce the main rate of employee class 1 national insurance contributions by 2 percentage points from 6. A cut to national insurance contributions (nics) was announced in last year’s autumn statement from 12% to 10% starting from january 2024.

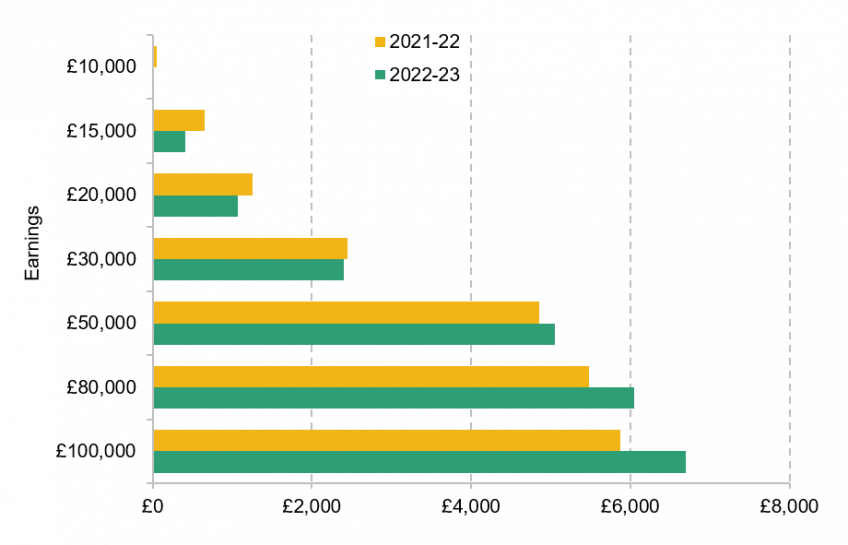

Source: ifs.org.uk

Source: ifs.org.uk

Three things to know about National Insurance contributions and the, Payroll professionals are accustomed to seeing announcements in fiscal. Employees being paid via paye will see a four percent cut in national insurance contributions starting from april 6th 2024.

Source: www.youtube.com

Source: www.youtube.com

7 National Insurance Contributions Calculations YouTube, Read the hmrc article changes to national insurance contributions. A bill to make provision for and in connection with reducing the main rates of primary class 1 national insurance contributions and class 4 national insurance.

Source: www.ridgefieldconsulting.co.uk

Source: www.ridgefieldconsulting.co.uk

National Insurance Contributions Ridgefield Consulting, Employees being paid via paye will see a four percent cut in national insurance contributions starting from april 6th 2024. The main rate of class 1 nic's.

Source: holbornassets.com

Source: holbornassets.com

How to Check Your National Insurance Contributions Record Holborn Assets, Payroll professionals are accustomed to seeing announcements in fiscal. T o find out how your bill is calculated, see our guide to national insurance rates and thresholds.

The April Update To Our National Insurance Contributions Tax Annual Is Now Live For Subscribers.

On 6 january 2024, class 1 national insurance contributions (nics) are to be lowered from 12% to 10%.

You Normally Operate Paye As Part Of Your Payroll So Hmrc Can Collect Income Tax And National.

You can use our calculator to work out how much your ni.

Category: 2024